What You Need to Know If You Have Student Loan Debt

In June, the Supreme Court struck down the Biden Administration’s plan for one-time relief for Americans with student loan debt that would have canceled up to $20,000 in debt per borrower. NGP’s got you covered for what’s next for the payment pause, the Biden Administration’s new repayment plan, and how to get involved with NGP’s campaign to cancel student loan debt.

What’s up with the payment pause?

Borrowers will need to start making payments again on October 1, 2023, and interest on loans will start to accrue on September 1, 2023.

The SAVE Plan

President Biden announced the Saving on a Valuable Education, or SAVE, Plan in July 2023. The SAVE Plan is an income-driven plan, meaning your repayments will be based on your income.

- The SAVE Plan calculates your monthly payment based on your income (after taxes!) and family size. If you don’t qualify for $0 monthly payments, the federal government estimates that you will still save roughly $1,000 with the SAVE Plan compared to other income-driven plans.

- The SAVE Plan raises the threshold for $0 monthly payments from 150% of the federal poverty line to 225%. That means that for individuals making less than $32,800/year and families of four making less than $67,500/year, your monthly student loan payment is expected to be ZERO dollars.

- If you meet your monthly payments under the SAVE Plan, any unpaid interest will NOT be added to your loan balance.

- Learn more about the SAVE Plan at studentaid.gov/save.

What are my next steps if I have student loan debt?

1) Check which repayment plan is best for you. Check out studentaid.gov/idr to figure out which plan is best for you.

2) Apply. Apply to the SAVE Plan (or other repayment plan) now. If you are already enrolled in the REPAYE Plan, you will be automatically moved into the SAVE Plan.

3) Don’t delay. If you apply for the SAVE Plan this summer, your application will be processed before you have to start making payments in October 2023.

Think the SAVE Plan is a good start, but not enough? We agree.

We thank President Biden for this first step, but more must be done to clear the crushing burden of student loan debt that impacts so many Americans, particularly Black and brown folks.

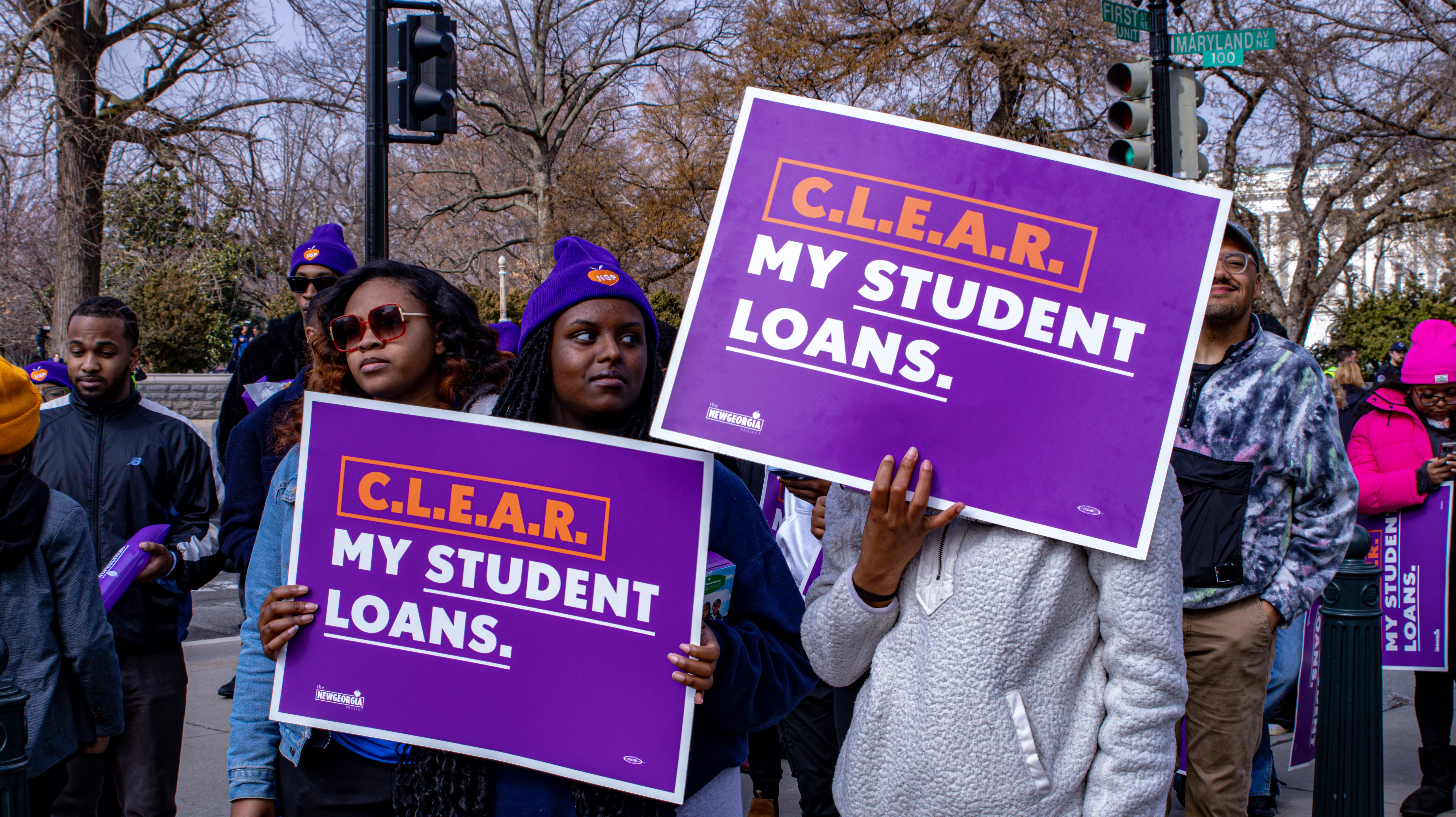

NGP’s C.L.E.A.R. Campaign—Cancel Loans for Education and Reparations—demands full student loan debt cancellation now. We need you in our fight. Sign our petition to demand FULL cancellation of student loan debt!

The information contained here and the resources available are not intended as, and shall not be understood or construed as, financial advice. New Georgia Project does not hold itself out to be, and the information contained on this website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

We have done our best to ensure that the information provided on this website and the resources available are accurate and provide valuable information. Regardless of anything to the contrary, nothing available on or through this website should be understood as a recommendation that you should not consult with a financial professional to address your particular circumstance. New Georgia Project expressly recommends that you seek advice from a financial professional.

Neither the New Georgia Project nor any of its employees shall be held liable or responsible for any errors or omissions on this website or for any damage you may suffer as a result of failing to seek competent financial advice from a professional who is familiar with your situation.